About BreachFin

BreachFin is a forward-looking financial technology firm committed to bridging the gap between data, trust, and financial insight. We believe that the future of finance is defined by transparency, security, and innovation—and our mission is to deliver tools and services that empower institutions, businesses, and individuals to manage risk and make smarter decisions.

Our Mission

At BreachFin, our mission is clear:

- To equip organizations with precise, timely, and actionable security intelligence

- To strengthen trust in sensitive financial and customer data through PCI DSS scanning and compliance-driven testing

- To provide accessible, enterprise-grade security services such as Pentesting-as-a-Service, empowering businesses of all sizes to proactively defend against threats

We merge deep expertise in cybersecurity, compliance, and data science to deliver solutions that anticipate risks, expose vulnerabilities, and enable decisive action.

From automated PCI DSS scanning to on-demand penetration testing, BreachFin ensures that businesses stay one step ahead of evolving cyber threats—fortifying resilience, protecting critical assets, and driving sustainable growth.

What We Do

At BreachFin, we deliver comprehensive security services designed to help businesses achieve compliance and strengthen defenses against modern cyber risks:

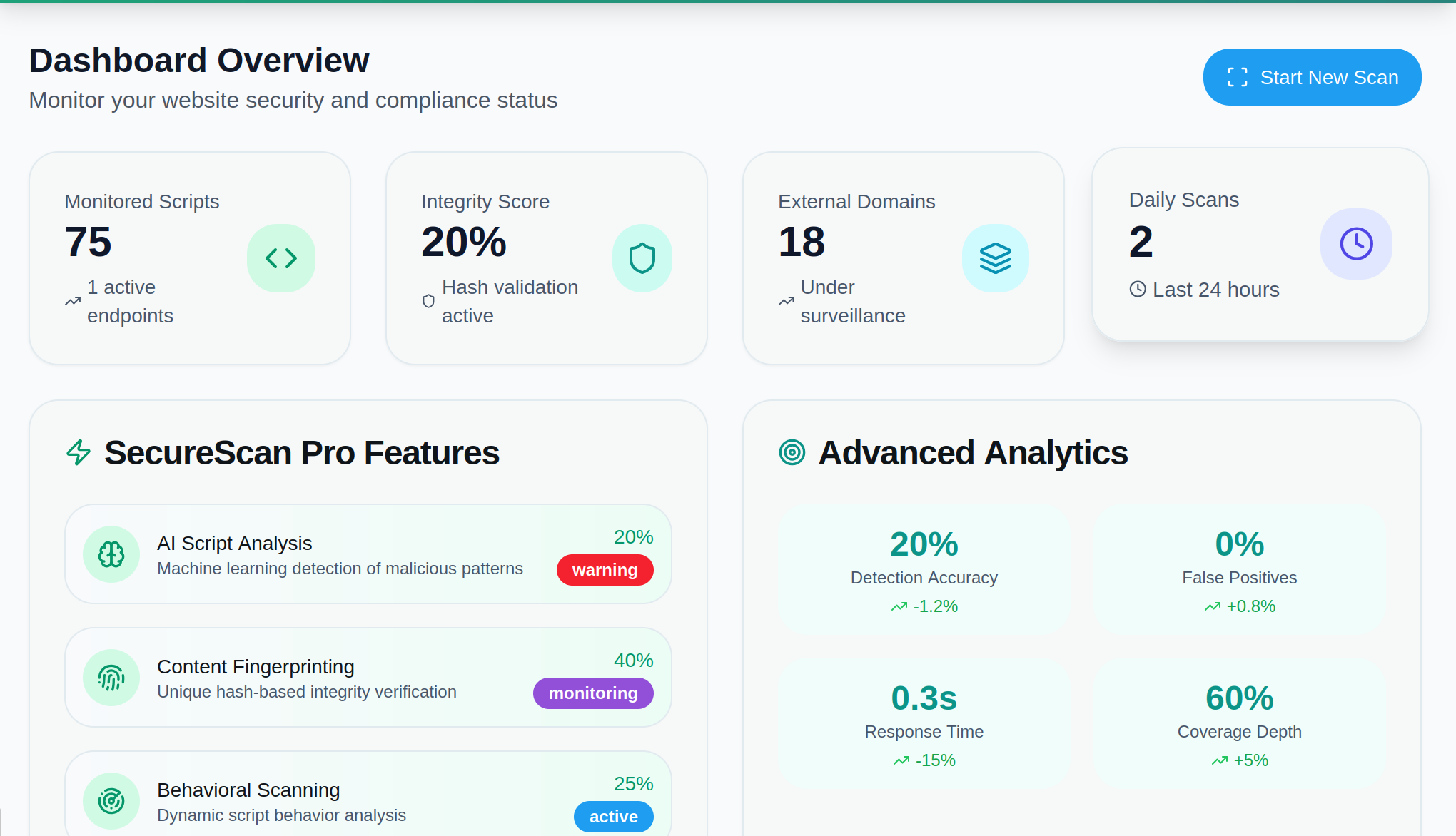

- PCI DSS Scanning – Automated, accurate scanning aligned with PCI DSS v4.0 requirements (including 11.6.1 and 6.4.3) to detect unauthorized script changes, monitor integrity, and validate compliance.

- Pentesting-as-a-Service (PaaS) – Continuous, on-demand penetration testing powered by expert methodologies and real-world attack simulations. We identify vulnerabilities before attackers can exploit them, ensuring proactive security.

- Vulnerability Intelligence – Actionable insights and reporting that prioritize risk, helping organizations remediate quickly and meet compliance obligations.

- Compliance Support – Tools and expertise to streamline audits, simplify reporting, and maintain ongoing adherence to regulatory requirements.

By combining automation with human expertise, BreachFin bridges the gap between compliance and real-world security—empowering organizations to operate with confidence in an evolving digital landscape.

How BreachFin Helps You Meet PCI DSS 4.0 Requirements 11.6.1 and 6.4.3

PCI DSS 4.0 Requirement 11.6.1 mandates that all organizations monitor payment pages for unauthorized changes to JavaScript and other content — a critical defense against web skimming and client-side attacks.

PCI DSS 4.0 Requirement 6.4.3 adds another essential layer: organizations must authorize every script on their payment pages, verify script integrity, and maintain an inventory with documented justifications.

BreachFin is purpose-built to help you comply with both — without the overhead of complex enterprise platforms.

Included in Every Plan:

- Daily scans of your payment and critical webpages

- SHA-256 hashing for tamper detection and script integrity checks

- Script approval workflow with justification tracking

- Entropy analysis & anomaly detection for suspicious script patterns

- Real-time alerts via email, Slack, or webhooks

- Audit-ready logs and historical script tracking

- Simple dashboard for scan scheduling and script management

- CSP/SRI tools to help enforce your approved script policy

Why “BreachFin”?

The name reflects our dual focus: “Breach”—highlighting the importance of detecting and responding to security or data breaches—and “Fin”, short for financial systems and the decision-making built around them. We operate at that essential intersection.

Why Do I Need BreachFin?

PCI DSS Requires More Than Internal Controls

Internal script approval processes and internal integrity checks are only the beginning.

PCI DSS 4.0 Requirement 11.6.1 mandates ongoing, browser-based monitoring and audit-ready enforcement.

BreachFin fills these critical compliance gaps:

1. Internal Approval ≠ Runtime Monitoring

Your CI/CD or internal controls can’t detect real-time, unauthorized script changes in the browser.

BreachFin scans the live DOM, exactly like your end users experience it.

2. PCI DSS 11.6.1 Requires “Runtime Monitoring”

The standard mandates ongoing monitoring of payment pages, not just static validation or Git-based integrity.

3. Audit-Ready Logging and External Validation

We give you QSA-accepted evidence:

- Timestamped script change history

- Approvals & integrity snapshots

- Exportable audit logs

4. No-Code Enforcement + Alerts

Real-time alerts for unapproved script execution via:

- Slack

- Webhooks

- And upcoming SIEM integrations

Our Principles

Collaboration & Open Learning

Security and finance are ecosystems. We partner with other firms, share insights, and contribute to collective resilience.

Integrity First

We treat client data and trust as sacrosanct. Security, privacy, and ethical conduct guide every decision.

Clarity Over Noise

Information is only useful when it’s understandable. We strive to make complex system indicators digestible, actionable, and reliable.

Proactive Posture

Rather than waiting for problems to emerge, we build systems and processes meant to foresee, anticipate, and mitigate risks before they escalate.

Why Choose BreachFin?

- AI Expertise: Cutting-edge technology to stay ahead of cyber threats.

- Custom Solutions: Tailored to meet your specific industry and compliance requirements.

- Cost-Effective: Scalable pricing models to suit businesses of all sizes.

- Continuous Support: AI-driven insights with a human touch.

Our Team

Our team brings together seasoned professionals from cybersecurity, financial analysis, regulatory compliance, and software engineering. We are united by the belief that responsible innovation must always go hand in hand with rigorous protection.

Who We Serve

Technology and fintech firms integrating breach and risk metrics

Financial institutions & banks seeking deeper breach visibility

Corporations & enterprises managing internal & third-party exposure

Regulators & oversight bodies who need better data inputs on risk